“We prefer options that are certain”

People tend to select options for which the probability of a favorable outcome is known (over an option for which the probability of a favorable outcome is unknown).

The ambiguity effect is relevant when a decision is affected by a lack of information, or “ambiguity”. The effect implies that we tend to select options for which the probability of a favorable outcome is highest. We simply have a reluctance to accept offers that are risky or uncertain.

Two remarks:

- Over an initial range, women require no further compensation for the introduction of ambiguity whereas men do.

- Curiosity increases attention, thus is induced by mild doses of uncertainty.

Scientific research example:

Imagine a bucket with thirty red, black and white colored balls. Ten of the balls are red (for sure), the others are ‘some combination’ of black and white (all combinations being equally likely).

Now you can choose between one of two games:

- Game ‘red’: drawing a red ball wins you $100

- Game ‘black’: drawing a black ball wins you $100

What do you choose? Well, most people tend to favor the ‘red’ game. Now, the probability of picking a winning ball is the same for both games (1 in 3). So why is the red game preferred? Well, simply because the probability of winning is known. The red game is less “ambiguous”.

One of the theoretical explanations for this ‘Ellsberg Paradox’ seeks the cause in our experiences with deception. We are suspicious people in situations where we are not told what the probability of an event is. This is because often – in real life commercial situations – it is usually in favor of the supplier, if he does not tell us how big a chance is. Our brain is simply afraid (and has an aversion) to be fooled.

Online Persuasion tips:

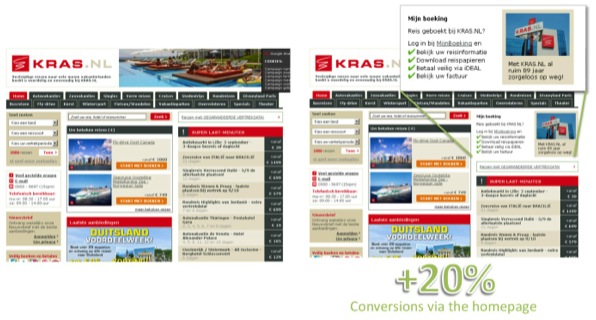

[checklist]

- Be specific in your offer and interaction (instead of offering vague information).

- Provide ‘feed-forward’ information (‘what’s next’).

- Use fixed discounts instead of a chance to win.

- Try to find the ambiguities in your competitors offer, and emphasize your certainty there.

- Guarantee your offer (money back, no cure=no pay).

- Within you portfolio, make your cash cow the ‘most certain offer’.

- Finally: in places where you need more attention, experiment with small doses of uncertainty.

[/checklist]

Online Proof

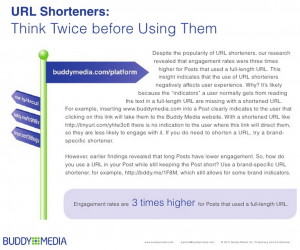

A nice example is the effects of using URL-shorteners. Since they introduce ambiguity in where the shortened ;ink will bring you, they tend to convert less.

Further reading on ambiguity aversion:

- Ambiguity aversion on Wikipedia

- Lex Borghans, Bart H.H. Golsteyn, James J. Heckman, Huub Meijers , NBER Working Paper No. 14713 (2009); “Gender Differences in Risk Aversion and Ambiguity Aversion”